This class was very interesting; we studied some of the basics of online algorithms as well as some applications to computational finance. Perhaps the most intriguing parts (for someone already familiar with online algorithms) were what we learned about classic computational finance, such as Black-Scholes-Merton.

This “project” is a review of the main result of an interesting paper, entitled “Making Decisions in the Face of Uncertainty: How to Pick a Winner Almost Every Time,” by Awerbuch et al. For details, check out the paper.

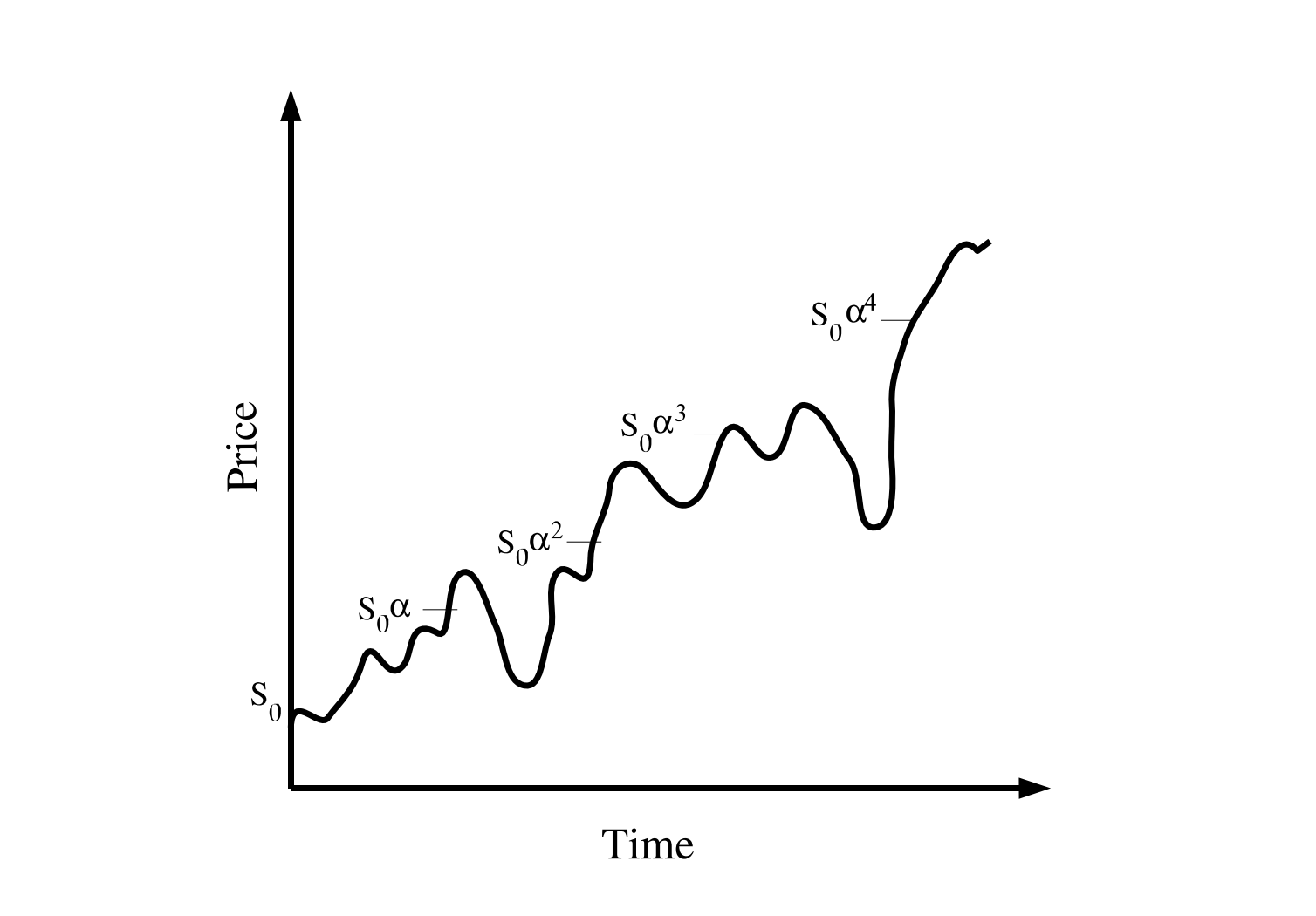

I also look at the possibility of using this algorcd ..ithm to make millions on the stock market…

Files: Paper (pdf).